A straight-forward, easy-to-use tracker for shared expenses & child support payments. Send secure e-payments, schedule payments, & create a clear legal record.

co-parenting Expenses

Co-parenting expenses and payments don’t have to be complicated

OurFamilyWizard helps you structure your expenses simply, quickly, and accurately.

What can you do with OurFamilyWizard's expenses and payments tracker?

With OurFamilyWizard® Expenses, you’ll spend less time on co-parenting finances, and you’ll face less stress from financial disagreements. (Plus, you’ll need fewer apps.)

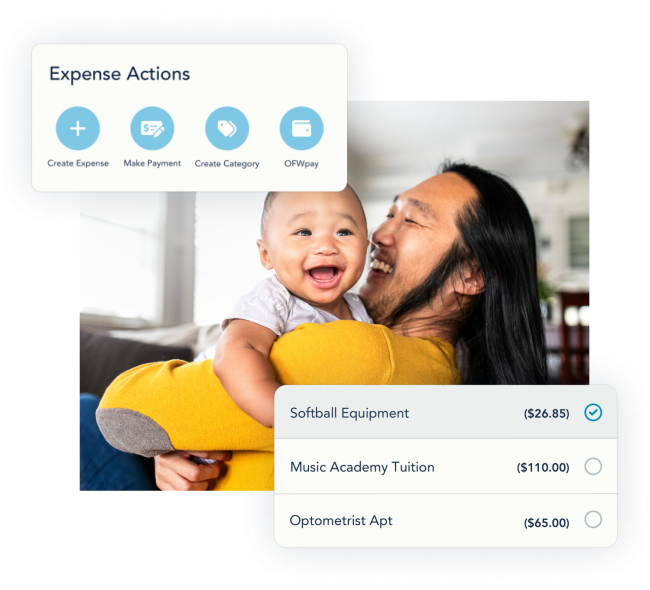

No more confusing spreadsheets or complex budgeting apps. Our Expenses feature is straightforward and easy to navigate. You don’t even need a separate app to pay—you have the option to pay in-app with OFWpay™. Keep everything centralized and simplified.

Money is a tough topic, but it’s easier when it’s streamlined.

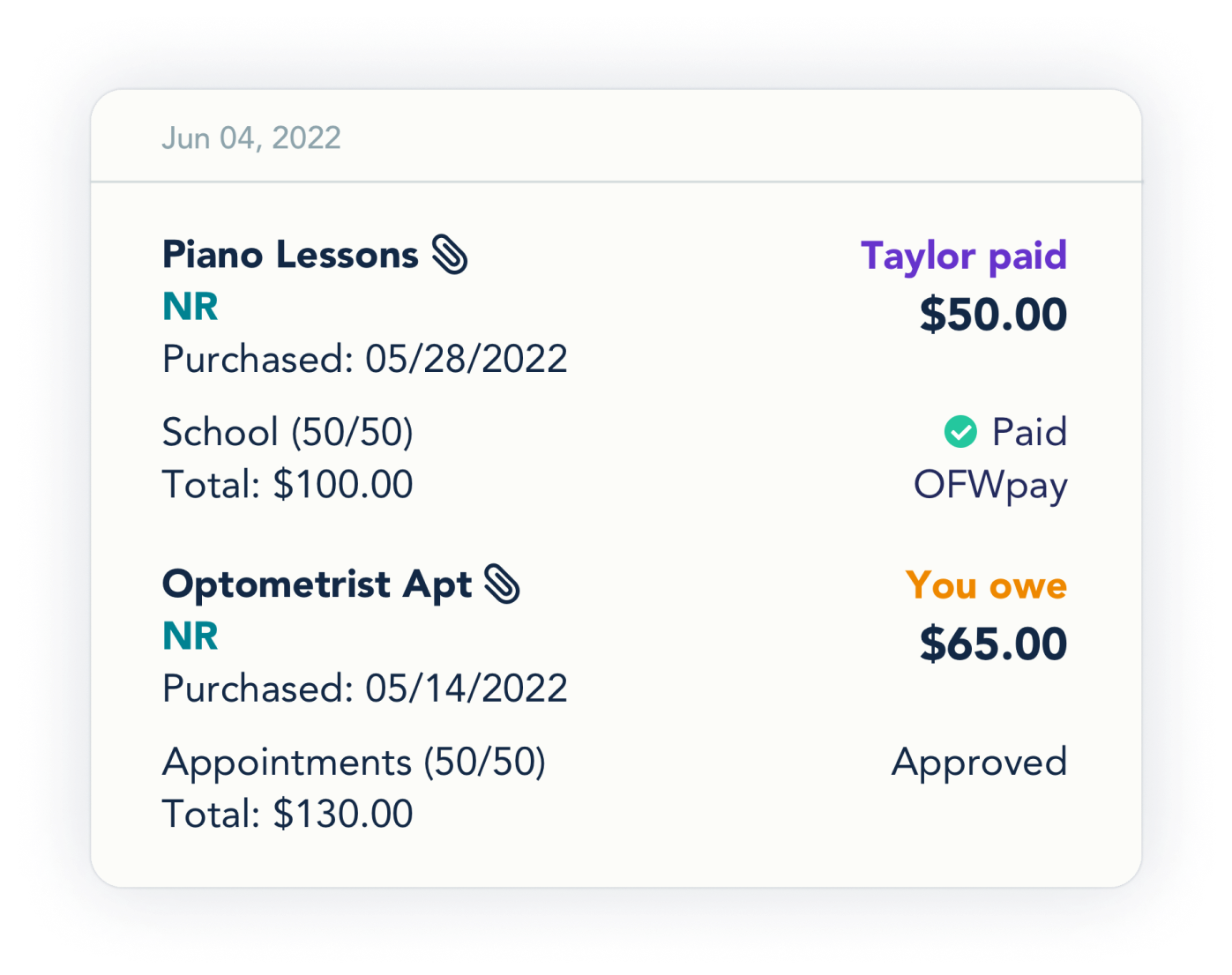

When you create an expense, you have to fill out all the fields (purchase date, category, amount, etc.). This template creates clear records. But the only open-ended field is “Expense name”—so you don’t have to open up a conversation beyond the facts.

Just a brief, business-like transaction.

Money talk can get complicated and even emotional—especially if it’s a case of your word against your co-parent’s. But if you logged a payment through the app or posted a reimbursement request with an attached receipt, then the record is clear.

It’s one way to cut down on conflict.

Pay child support and shared expenses in the app

With OFWpay, you can pay directly in the app. (Available for U.S. co-parents.)

- Make secure e-payments

- Create a definitive record

- Set up scheduled payments

- Use fewer apps for co-parenting

Reimbursement requests are automatically updated when you pay through OFWpay. You can also pay via “check-other” (like Zelle, Venmo, or PayPal) and log it in your account. But paying through OFWpay means there’s indisputable proof of every payment. You can even set up scheduled payments for child support or other expenses, and they’ll send automatically.

Shared expenses tools that save you time, trouble, and tension

Expense Log

See a full list of expenses or check on the status of each individual expense. You can also see a summary of outstanding expenses for each co-parent. No more arguments over who owes what.

Custom categories

You’ll start out with default categories, but you can also add your own, along with custom percentage splits. This way the Expenses feature reflects your parenting agreement and keeps everyone on the same page.

Add receipts

You can snap a photo from inside the app as you’re creating an expense, and it will automatically attach. A quick and easy way to show what you spent.

Reporting

On the website, you can generate four types of reports: transactional, chronological, statistical, and payments. You can also print individual expenses. Whenever you need a clear track record, you’ve got it.

We set the standard for co-parenting expense trackers

You won’t find all these features together in any other app.

Co-parenting expense tracker: FAQ

Have more questions? Contact Us. We’re happy to help.

How do payments work in OurFamilyWizard?

In Expenses, you can pay one or more expenses at a time, and you can pay them in full or in part. You can choose to pay by “check/other” or by OFWpay (if you have it set up).

How do I set up OFWpay?

Once you’re in Expenses, select OFWpay, then tap “Get Started.” Enter the required information to link your bank account. Your co-parent will need to do the same—and then you’ll see the OFWpay option when making a payment.

Can I edit or delete an expense?

Yes but only if you created it, and your co-parent hasn’t responded yet. Once it becomes a two-way interaction, it’s a permanent part of the expenses record.

What if my co-parent creates an incorrect expense?

If your co-parent sends a request that is inaccurate, you always have the option to refuse the request. It is still logged in the register, but marked as “refused.”

Easily document child support payments and shared expenses

- Permanently log every expense

- Track all expense activity in one place

- Create custom PDF reports quickly

- Save time, stress, and legal fees

If you give your family law professionals access, they can download court-admissible expense reports, too.

Are you ready to simplify your co-parenting expenses?

Get started today with OurFamilyWizard.