Reasons for Child Support Modifications: Increasing, Decreasing, & Ceasing Payments

Child support often changes as the child grows and the parents’ circumstances shift. Explore why co-parents and courts increase, decrease, or end child support. Get expert tips on the process and explore your state’s requirements.

Reasons why courts order support

Judges order child support to make sure that children get enough financial support from both parents after a separation or divorce. Child support covers basic needs like food, shelter, healthcare, and education. It puts the child’s well-being front and center and divides the parents’ responsibilities fairly.

“Child support is the right of the child,” explains Conti Moore, attorney and owner of Conti Moore Law Divorce Lawyers, PLLC. “We establish and order child support to make sure that the co-parents are providing the basics for the child like food, housing, clothing, health care, and more. It’s about fairly spreading out the financial cost of raising their child and ensuring that the custodial co-parent has the resources to provide for the child.”

owner of Conti Moore Law Divorce Lawyers, PLLC. “We establish and order child support to make sure that the co-parents are providing the basics for the child like food, housing, clothing, health care, and more. It’s about fairly spreading out the financial cost of raising their child and ensuring that the custodial co-parent has the resources to provide for the child.”

Child support can be tricky to calculate, especially if two co-parents divorce when their child is young. As the child grows, their needs change, and the co-parents’ financial resources might change too. But no matter what changes, the child will still need to receive support.

“Kids are not free,” says Faith Brown, a family law attorney and mediator at Brown, Brown, and Kuhn. “But life also isn’t always steady and stable. You might lose a job or get a raise. Maybe your child’s needs will change. Courts recognize that parenting and life are dynamic, and that’s why there are processes in place in every state to modify child support when necessary.”

life also isn’t always steady and stable. You might lose a job or get a raise. Maybe your child’s needs will change. Courts recognize that parenting and life are dynamic, and that’s why there are processes in place in every state to modify child support when necessary.”

When circumstances change, many co-parents adjust their parenting plans and child support orders. However, since finances are a sensitive topic, you have to go through the court in your jurisdiction to modify child support. It’s a detailed process.

Key findings:

- Co-parents adjust child support when they face a big change in circumstances, such as shifts in income, custody schedules, or the child's needs.

- Legally, child support is the child's right, and the court has to approve formal changes.

- Child support often increases when the paying co-parent's income rises significantly.

- On the other hand, child support may decrease if the child's needs change, the paying parent's income drops, or the child spends more overnights with that parent.

- To change child support, you’ll likely need to submit a request to your local jurisdiction, share financial information, and possibly attend a court hearing.

How child support payments are calculated

Legal professionals use mathematical models to calculate child support. They consider the co-parents’ incomes, the custody schedule, the child’s needs, and more. The goal is always to make sure that both parents contribute fairly.

Different states and jurisdictions use different models, and they might weigh the variables differently in the calculation.

Although the models vary, they all agree on the two most important factors: the income difference between the co-parents and the difference in the number of overnights with their child.

Erik B. Chambers, a family law attorney and guardian ad litem at Stern Edlin Graham Family Law, explains the idea behind child support: “The more one co-parent earns, and the less time they spend with the child, the more they should be paying to the other co-parent in child support.” Chambers has more than 12 years of experience, specializing in high-net-worth divorce and litigating contested custody cases in the metro Atlanta area.

the idea behind child support: “The more one co-parent earns, and the less time they spend with the child, the more they should be paying to the other co-parent in child support.” Chambers has more than 12 years of experience, specializing in high-net-worth divorce and litigating contested custody cases in the metro Atlanta area.

Chambers adds: “We will also factor in variables like how many overnights each parent has with the child and who pays for important expenses like childcare and health care. Usually, these calculations will result in the higher-earner co-parent paying support to the other co-parent.”

The states’ exact calculations vary, but they all consider income, custody arrangements, and costs like housing, education, and healthcare. Also, they accommodate special circumstances like very high or very low income or a child with unique needs.

Here's a brief overview of the three main models that states use to calculate child support:

- Income shares model

The concept here is that parents should give the same proportion of their combined income as though they weren’t separated. So if one co-parent earns 70% of their combined income, then that co-parent would pay for 70% of the child’s living costs. This model uses a pro-rata approach (which means “in proportion”). According to the National Conferences of State Legislatures (NCSL), 41 states used the income shares model as of 2020. - Income percentage model

This model emphasizes the non-custodial co-parent’s actual income, instead of the proportionate income. It factors in the custody schedule and childcare expenses to determine what income percentage the non-custodial parent should pay. - Melson formula

The Melson formula starts with the income shares model but then also considers the co-parents’ needs. According to NCSL, only three states (Delaware, Hawaii, and Montana) use this more complex model.

After a court calculates and orders child support, some co-parents use direct or indirect payments via bank transfers or apps. In other cases, the court orders wage garnishment to remove the child support amount from the paying co-parent’s paychecks.

Ideally, the co-parents will collaborate to manage child support payments and track child support to ensure transparency. The child support order will also have a section about handling arrears, which means overdue or unpaid child support.

Reasons to modify child support

Co-parents can ask to modify child support when circumstances change. This could include a change in income, custody schedule, or the child’s needs. For example, the child might no longer need daycare, or they might start attending a private school.

Child support should be a fair and equitable split of the child’s basic expenses. However, life circumstances are bound to change. Co-parents might want to modify their child support to account for a new job, changing expenses, or an adjusted custody arrangement.

“Changing your child support arrangement is fairly common,” Chambers says. "Especially for couples who separated when their child was young, it's likely that various life events will prompt a reevaluation — whether it's a career change, evolving needs of the child, or a change in the custody arrangement.”

Conti Moore says that it really matters whether the change is permanent. "You can't simply request a modification right after losing a job," Moore notes. "The court will only consider a permanent change, one that’s already gone on for around a year or longer. Also, if you’re requesting a decrease in child support, it's essential to demonstrate that the change was unintentional, not an attempt to reduce support payments."

Reasons to increase child support

A common reason for increasing child support is a change in the custody schedule that gives one co-parent more parenting time. Or if one parent’s income rises or falls dramatically, or if the child’s needs change, that can also prompt an increase.

Here's an overview of the reasons why child support might increase:

- Custody schedule change

Each parent’s percentage of overnights with the child is an essential factor. If the co-parents adjust their custody schedule and the non-custodial co-parent gets significantly fewer overnights, then child support should change accordingly.

“In many cases, a change in child support is connected with a change in the timesharing schedule,” Brown says. “For example, if one co-parent moves closer and wants to switch from an 80/20 schedule to a 50/50 schedule, the increase in overnight parenting time would require a change in child support.”

Brown adds: “When a co-parent has more parenting time, they’re going to incur more of the day-to-day expenses associated with raising the child. So, because the co-parent is already covering more of the child’s expenses by virtue of being together more, the idea is that they should contribute proportionally less to child support to the other co-parent.” - Substantial income change

If the paying co-parent's income increases significantly, their child support payments may also need to increase. These changes can result from a significant raise or inheritance. To validate a change in child support, the income change has to be permanent.

“It has to be a substantial increase in income,” Chambers says. “Some states have a specific definition of what ‘substantial’ entails. Others leave it up to the judge to decide if the co-parents don’t agree and the matter goes to court.”

An income increase can widen the income disparity between the co-parents. When one co-parent earns a much higher percentage of their combined income, the standard pro rata “income shares model” may dictate that they contribute a larger proportion toward the child's needs.

In such scenarios, the parent receiving child support may petition for an increase in support. Increasing child support can enhance the child's standard of living now that the other co-parent can contribute more.

"It's not mandatory for one co-parent to notify the other about an increase in income," explains Chambers. "Ideally, in a cooperative co-parenting dynamic, the paying co-parent would share any increase in income openly. However, it’s not uncommon for one co-parent to remain unsure of any change in income unless they actively seek out this information from the other co-parent or file an action to modify child support to obtain a financial affidavit and other pertinent documents." - Cost-of-living (COLA) clause

Some child support orders include a “cost of living adjustment” (COLA) clause. This clause automatically accounts for the reality that the cost-of-living increases over time. In these situations, child support automatically increases, and neither co-parent has to submit any modification or petition. - Worsening finances of a co-parent

Moore further explains if the custodial co-parent's income declines, that can also impact the proportion the non-custodial parent must contribute.

"If the custodial co-parent experiences an involuntary loss of employment or a shift in their earning capacity, they may petition for a modification to adjust the percentage, resulting in an increased child support obligation for the paying co-parent,” Moore says. “However, it's crucial for the co-parent requesting the change to demonstrate that the circumstances are ongoing, permanent, and not a deliberate attempt to decrease income or earning potential." - Higher childcare expenses

As children grow, their needs will change, and they might require more financial support. Still, it's essential to recognize that child support doesn’t cover all child expenses.

"Child support primarily covers essentials," Brown emphasizes. "This includes childcare, healthcare, food, basic education, and housing. However, extracurricular activities typically fall outside the realm of child support. Co-parents, along with their legal representatives, usually discuss and establish a plan for covering these shared expenses when creating their parenting plan."

Reasons to decrease child support

The main reason to decrease child support is if the payer’s income permanently decreases. Another reason is if the co-parents change the custody schedule so that the paying parent has more overnight parenting time. A change in a child's needs can also decrease child support.

- Involuntary and permanent decrease in paying co-parent’s income

A common reason for decreased child support is when the paying co-parent experiences a significant and permanent decrease in income. For example, the co-parent may lose a job.

According to Moore, though, co-parents need to realize that a court won’t grant a modification the moment someone loses their job.

“Courts give the paying co-parent time to find new employment or stabilize their financial situation before considering a modification of child support,” she says. “Just because your situation changes, the child’s needs don’t change with it. Most co-parents will need to make a clear case that they cannot reclaim their former income level.”

Chambers reinforces these points.

“Courts will consider a parent’s earning capacity, not just their actual income,” Chambers says. “That means that anyone claiming a decrease in income will need to show an inability to earn what they were earning previously due to illness, layoffs, or an industry downturn, for example. That also means that if you choose to go to school or choose to go down to part-time, you’re not necessarily eligible for a child support modification.” - Significant change in the co-parent’s capacity to earn or pay basic expenses

In extreme cases, the paying co-parent may suddenly not be able to earn as much money, or their healthcare expenses may skyrocket. For example, if the paying co-parent is incarcerated, they may not have the means to support the child. Or if they undergo a severe medical change, they might suddenly be straddled with new and critical expenses. - Reduced child expenses

Another factor that may lead to decreased child support is a reduction in the child's expenses.

“Many people change their child support after the child grows old enough not to need childcare,” Chambers explains. “There also might be a decrease in medical or educational costs over time that could warrant a modification.” - Custody schedule change that gives the paying co-parent more overnights

When the custody schedule changes so that the paying co-parent has more overnight parenting time, that can also decrease child support.

“The number of overnights each co-parent has is a critical variable in the models we use to calculate child support,” Brown says. “When a co-parent has more overnights with the child, the idea is that they’ll now be assuming more of the financial responsibility associated with caring for the child in person. That means they shouldn’t have to pay as much in child support since now they are just paying for it in person as they care for the child.”

Why a judge would approve child support modification petitions or motions

Judges might approve child support modifications or petitions if the circumstances change substantially. The judge will only support changes that still meet the child's needs.

According to Moore, most judges will support a modification that meets two key requirements:

“First, the petition must show a substantial change in circumstances related to income, the custody schedule, or the child’s needs,” Moore says. “Second, in the case of a decrease in child support, the judge will make sure that the child will still have enough financial support for their basic needs like housing, education, and healthcare.”

Here’s a more detailed look at why a judge might approve child support modification petitions or motions:

- Substantial change in circumstances

A judge will approve child support modification petitions when substantial changes in circumstances justify it. This can include changes in income, employment status, health conditions, or the living arrangements of either parent. States have different definitions of what’s “substantial.” Some states leave the decision to the judge’s discretion, while others define it based on a percentage of income change. - Child’s best interest

Above all, the court's highest objective is to protect the child’s welfare and rights.

"Child support fundamentally belongs to the child," emphasizes Moore. "A judge is unlikely to favor modifications that substantially diminish the overall financial support available to the child, unless absolutely necessary." - Both co-parents agree to the change

If both co-parents agree to modify the child support and submit a joint petition, the judge will likely move through the modification more quickly. - It’s been at least three years since the original order

In many states, co-parents have the right to formally reassess their child support arrangements after three years, regardless of whether there has been a substantial change in circumstances. This timeline allows co-parents to request financial affidavits to be more transparent about one another’s income and make adjustments for the rising cost of living.

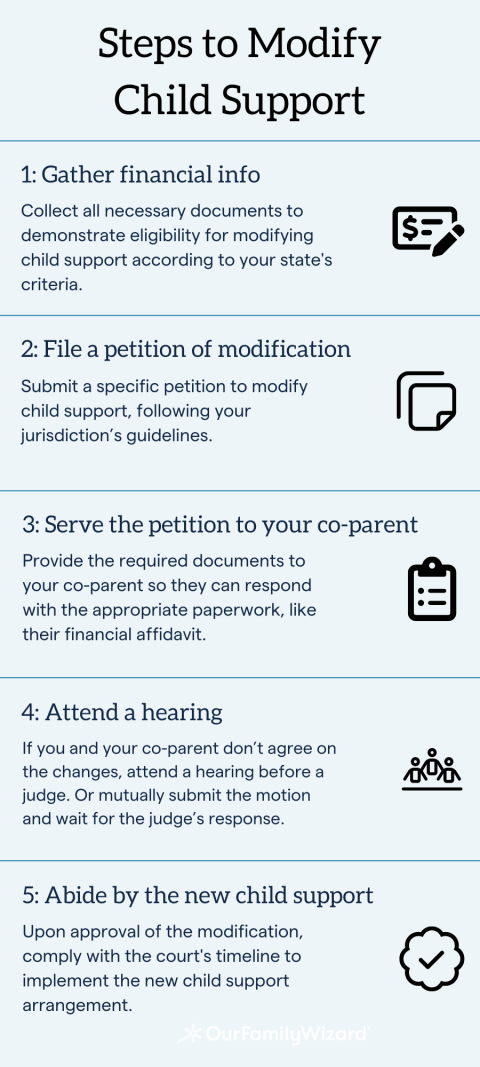

Process for requesting a child support modification

One co-parent must submit a petition for a child support modification. The process depends on whether both co-parents agree to the changes. The court usually needs proof of a substantial change in circumstances. The court will also make sure that the modification still meets the child’s needs.

The specific process for requesting a child support modification depends on your jurisdiction. Still, all areas follow the same basic framework.

Here's a list of the broad steps involved in requesting a child support modification.

- Gather necessary information

Before filing a request for child support modification, gather all relevant information, such as financial documents, employment records, and the custody agreement. This step is particularly important if one co-parent claims the other has an income increase that enables them to pay more.

Chambers recommends that a co-parent consult with their family law attorney before filing a modification petition.

“A lot of times, I will meet with a client who suspects that their co-parent has a change in income and believes it’s grounds for a modification,” Chambers says. “In these cases, I can run the possible numbers for the client and we can engage the initial co-parent with a letter of intent describing the expected situation and showing them the anticipated numbers.” - File a petition or motion

“You must file a supplemental petition for modification, usually in the same jurisdiction where you received your original child support order,” Brown says. “As part of the petition, you’ll have to provide a financial affidavit to outline your financial situation.”

The specific forms vary by jurisdiction, so talk to a family law attorney for guidance. - Officially notify the other party

“If the modification started with a co-parent filing an action, then eventually that co-parent will have to formally notify the other co-parent that they have made a petition,” Chambers says. “Most co-parents will have already talked with the other co-parent about the potential change. But it’s important to do it officially as well, and serve the official paperwork on the other, usually non-custodial, co-parent. The exact process varies based on jurisdiction. This process gives the co-parent notice of the proceedings and an opportunity to respond and provide the necessary documents.”

When the other parent receives the notification, they have to submit a financial affidavit to make their earnings and financial situation transparent to the court. - Attend a hearing (if applicable)

When co-parents cannot agree on the proposed change, they must attend a hearing and present their case before a judge. However, it's important to note that in many states, co-parents who mutually agree on the modification can submit the petition and documents to the judge for approval without a hearing. - Await the decision

It’s important to note that the time it takes a judge to decide depends on several factors, including the case's complexity, the court’s docket, the specific legal procedures, and whether one of the co-parents is contesting the claim.

If the judge approves the modification, both co-parents need to comply with the order within a specified timeline.

The procedures and requirements are different in different jurisdictions, so it’s best to talk to a qualified family law attorney in your area.

How states vary on the child support modification process

State procedures for modifying child support can vary quite a bit. Some states outline specific criteria for when a parent can seek a modification, while others leave the decision up to the judge. Also, states might use different models to calculate child support.

Here’s a summary of the ways the child support modification process varies by state:

- Different ways to calculate child support

Most states use the “income shares” model, based on each parent’s proportional share of their combined income. But some states use an income percentage model, and others might include or weigh variables differently. All states mostly consider income, the child’s needs, and the custody schedule.

It’s critical to speak with a family law attorney in your jurisdiction. They’ll have valuable insights about your child support arrangement. - Varying “thresholds for modification”

The “threshold for modifying” a child support order is a list of criteria for initiating a change. Some states have specific minimum child support thresholds. For example, in California, the order must reflect a 20% change in child support or a minimum of $50, whichever is lower. In Florida, it's a 15% change or a minimum of $50. Georgia lacks a specific threshold and leaves the decision to the judges.

States also have different ideas about how long a change has to last before you can request a modification. For instance, Idaho mandates that the substantial change must last for at least six months, whereas Florida requires that a permanent change last at least one year. Some states don't specify a timeline, leaving the decision to the judge. - Form requirements

Different states require different documents for a child support modification. Although all states require some form of petition or motion, the titles of these documents can differ. Typically, most documents request similar information, such as a financial affidavit and an expense log. - Different procedure requirements

States have different procedures for initiating or concluding a child support modification request. Some specify that both co-parents have to attend mediation and a hearing, while others let parents complete some or all steps online. The details might differ based on whether both co-parents agree on the proposed changes.

Reasons why child support payments end

Child support usually ends when the child turns 18 and is legally an adult. If children emancipate themselves earlier, child support will end then. Significant changes in custody or financial circumstances might also end child support. The last reason is the death of the child or parent.

Here's a summary of the major reasons that child support payments end:

- Child turns 18 (“age of majority”)

Most jurisdictions end child support when the child reaches the “age of majority.” That’s when a person legally gains the rights and responsibilities of an adult. Almost all states define this age as 18, but some states, like Mississippi, set it at 21.

Most states also tie the “age of majority” to the age of high school graduation.

“For children who turn 18 at the beginning of or during their senior year in high school, child support will typically extend until they graduate,” Chambers says. - Emancipation of child

If a court grants emancipation, parents don’t need to pay child support anymore. Courts may also consider other signs of self-sufficiency, like marriage or military service, as emancipation. - Death of a child or parent

If the child or parent dies, child support ends. - Significant life changes for the child

Some states change child support requirements if the child attends college before turning 18 or is incarcerated. Check your state’s rules for details. - Termination of a parental right

A termination of parental rights permanently ends legal ties between a child and their parent, including child support. Although courts try to uphold most parent-child relationships, extreme cases like child abuse or a history of assault might convince the court to terminate that individual’s parental rights. - Significant and permanent decrease in income

If a parent's income decreases very significantly, it could lead to a termination of child support payments. Consider factors such as job loss, reduction in hours, or disability. In that case, they may petition the court to modify the child support order to reflect their inability to pay.

Chambers points out, however, that it would be very difficult to end child support based on a decrease in income. “It would likely have to be an extreme decrease or change in the parent’s life that is permanent and shows they clearly can no longer support the child. But the court will always try to make sure the child receives some support if at all possible.”

Easiest way to manage child support and expenses

Navigating child support can be overwhelming, and raising children is expensive. Managing these costs can often lead to conflict. That's why OurFamilyWizard provides a centralized platform where you can conveniently track, document, and make direct payments for child support and shared expenses.

OurFamilyWizard’s shared expense log helps co-parents accurately track and manage shared expenses, which encourages transparency and collaboration between co-parents. By providing a clear overview of child support and expenses, OurFamilyWizard promotes trust and cooperation in co-parenting.

With OurFamilyWizard, you can focus on what truly matters—raising your child—without the logistical hassles getting in the way.