Co-Parenting Shared Expenses 101: Full List of Child Expenses, Budget Templates and Expert Tips

Cooperation, rather than conflict, can shape the management of co-parenting expenses. Our comprehensive co-parent shared expenses guide covers everything you need to know about co-parenting finances. Learn about shared expenses and budgeting and read expert advice on how to prevent common issues.

What Are Shared Expenses in Child Custody?

Shared expenses in child custody refer to any child-raising costs that co-parents share. Co-parents divide and share the expenses according to their agreed-upon arrangement. Common expenses include unreimbursed medical bills, electronics, entertainment, and personal care.

After a separation or divorce, both parents have financial obligations to raise and provide for their child or children. Shared expenses are distinct from child support, where one parent pays another to support fundamental expenses.

"Money can sometimes create discomfort, but it shouldn't overshadow the focus on the child's well-being," says Jennifer Warren Medwin, MS, CDC and Florida Supreme Court Certified Family Mediator, “How co-parents divide shared expenses may vary, but it should always be fair and equitable. It's crucial to emphasize that fairness doesn't always equate to a 50/50 split. The key is to maintain a mentality of teamwork for the sake of your children." Medwin specializes in people contemplating divorce or hoping to save their marriage.

focus on the child's well-being," says Jennifer Warren Medwin, MS, CDC and Florida Supreme Court Certified Family Mediator, “How co-parents divide shared expenses may vary, but it should always be fair and equitable. It's crucial to emphasize that fairness doesn't always equate to a 50/50 split. The key is to maintain a mentality of teamwork for the sake of your children." Medwin specializes in people contemplating divorce or hoping to save their marriage.

Co-parents detail how they will share expenses in their parenting plan, a legal document co-parents submit within their marriage settlement. The language in the parenting plan is critical and will guide future financial decisions and outcomes.

Ultimately, the goal of sharing expenses in child custody is to ensure that the co-parents meet the child's financial needs to provide a supportive and stable upbringing.

How Do You Split Expenses with a Co-Parent?

To split expenses, co-parents consider factors like income and custody arrangements. Then, they try to make a system that fairly divides expenses between the two parties. It’s often not a 50-50 split. They detail their system in a parenting plan.

The default way co-parents split expenses is to use “pro rata” splits, or splitting costs according to each co-parent’s income. Co-parents generally divide expenses in proportion to each co-parent’s ability to contribute. Co-parents with joint custody also consider their specific custody arrangements when deciding how to create an equitable distribution of expenses.

Still, incomes can vary over time, and other issues can emerge. Splitting expenses with a co-parent first requires a basic understanding of the different expenses that can arise.

Here are common questions about splitting expenses with a co-parent.

What co-parenting expenses are usually covered by child support?

Child support typically covers your child’s basic living needs, which may include:

- Food and groceries

- Clothing and shoes

- Housing and utilities

- Basic education costs (in some states)

“Think of child support like being reimbursed for a basic expense,” says Elizabeth Burchell, family attorney at Busciglio, Sheridan & Schoeb in Tampa, Florida and author of a children’s book on divorce. “Child support payments cover the fundamentals—food, clothing, housing, gas, utilities. Elizabeth also represents children as a guardian ad litem and volunteers at her nonprofit, Chicktime Tampa, for teens in foster care.

Child support coverage can vary depending on your state. For state-specific guidelines, calculation tools, and legal procedures, consult this comprehensive guide. Select your state to learn more.

What expenses are not covered by child support?

According to Burchell, child support covers basic daily expenses, but not shared expenses or any extraordinary expenses one parent may incur during timesharing. Shared expenses, such as medical, extracurricular activities and educational fees, require contributions from both co-parents. On the other hand, extraordinary daily expenses, like taking a child to a theme park, vary based on individual parenting styles. Some parents make a specific designation in the parenting plan to define shared expenses, while others handle larger needs as they arise.

Expense Category | Typically Covered? |

Food, clothing, housing, utilities | Yes |

Healthcare (insurance & out-of-pocket) | Yes |

Childcare (if necessary for work/school) | Yes |

Education (basic school costs) | Often included* |

Extracurriculars & tutoring | Sometimes included |

Private school, vacations, college | Usually excluded* |

*May require special legal provisions or parental agreement.

Do co-parenting shared expenses vary on relationship status?

“If you have a child, you have a fiscal responsibility for that child,” says Burchell. “Entering into a parenting plan that clarifies expenses for shared responsibility outside of child support is the best way for each co-parent to clearly understand their projected fiscal contribution for the child.”

Co-Parenting Shared Expenses List

Co-parents often share child-related costs beyond basic child support. These expenses may include healthcare, education, activities, transportation, and more. The exact expenses vary by family, but here are the most common categories with examples.

Medical Care

Covered healthcare costs such as:

- Health insurance premiums

- Copayments

- Prescription medications

Uninsured Medical Expenses

Healthcare not covered by insurance, including:

- Out-of-network medical care

- Uncovered prescriptions

Dental Care

Preventive and treatment costs like:

- Cleanings

- Fillings

- Braces and orthodontics

Personal Care

Hygiene and grooming expenses, for example:

- Haircuts

- Shampoo and skincare

- Toothpaste, deodorant, lice treatments

Educational Fees

School-related costs, including:

- Registration fees and textbooks

- Tutoring services and supplies

- Field trips, yearbooks, dance fees

Technology & Electronics

Child-related devices and accessories:

- Laptop or tablet

- Phone

- Headphones

Extracurricular Activities

Costs for sports, lessons, and clubs:

- Uniforms and equipment

- Camp registration

- Music lessons or competition travel

Childcare

Daycare or supervised care, such as:

- Daycare tuition

- Nursery school

- Before/after school care

Transportation

Travel and commuting costs:

- Gas and parking fees

- Bus or train fares

- Airplane tickets

Entertainment & Hobbies

Recreational and creative activities:

- Musical instruments

- Art supplies

- Movie tickets or sports gear

Children’s Pet Expenses

Pet-related costs tied to the child:

- Food and toys

- Grooming and vet check-ups

- Vaccinations

High-Ticket Special Events

Major one-time or milestone expenses:

- Prom dress or senior trip

- First car purchase

- Graduation fees

Vacation & Travel

Shared family or child-only trips (if agreed):

- Airfare

- Lodging

- Event tickets

Tips for Managing Co-Parenting Expenses

Follow these tips to manage co-parenting expenses effectively: Communicate openly with the other parent. Keep track of expenses. Create a budget. Consider online tools. Above all, prioritize the child's needs. Collaboration and organization are key.

Here are detailed tips for managing co-parenting expenses straight from the experts:

- Draft a forward-thinking parenting plan

"It's all too common for co-parents to overlook the significance of factoring in future expenses that may not be immediate concerns but are bound to arise," explains Elizabeth Burchell. "They fail to anticipate the ongoing rise in basic needs and costs. Things catch them off guard, like braces for their teenager (who was a 3-year-old at the time the co-parents created the parenting plan) or their children's emerging passion for competitive dancing, entailing substantial competition fees. A forward-thinking plan is paramount to avoid contentious disputes over financial responsibilities."

Even when co-parents intentionally discuss future expenses, the conversation can be difficult to navigate alone. Questions like “Who will pay for college?” aren’t easy to answer.

That's why mediator Jennifer Warren Medwin strongly advises co-parents to seek the guidance of a divorce coach or a similar professional. Medwin stresses the importance of outside support.

“It’s always best to have expert assistance when planning for potential conflicts,” she says. “By anticipating and addressing these issues beforehand, you can spare yourself the stress of mediating them in high-pressure situations. Having a supportive coach by your side while drafting legal documents is essential as they can help identify potential pitfalls that may otherwise go unnoticed." - Be as detailed as possible in your parenting plan

“Many people initially create simplistic parenting plans that leave room for interpretation," explains Burchell. "While co-parents may agree on certain terms initially, it is inevitable that they’ll find themselves interpreting the same paragraph differently, necessitating a return to the lawyer for modifications.

Burchell adds: “To begin, your parenting plan should clearly outline the method of payment for reimbursement and establish a solid framework for handling shared expenses. Does your parenting plan clearly state whether both parents are contributing to all activities or only to agreed-upon activities? When it comes to the specifics of these expenses, it's essential to consider every detail meticulously.

Similarly, Burchell recommends discussing expenses within their broader categories. And, within each category, try to list everything that may come up, especially if one parent believes that the other may challenge the expense in the future.

“If you decide to share ‘educational expenses,’ does that include yearbook photos?” asks Burchell. “Maybe one co-parent naturally assumes yearbook photos are obviously an educational expense, and the other doesn’t. These gaps in detail are where conflict is born. Uniforms for school sports or rentals for musical instruments are other aspects that require careful consideration. In the realm of co-parenting, attention to detail is of utmost importance.” - Document everything

"Document, document, document!” Burchell advises. “Having clear records of bills and proof of payment can work wonders in resolving any legal conflict over financial responsibilities. Effective communication is key, and utilizing a co-parenting app that securely stores all messages can help maintain clarity and transparency."

“Put everything in writing” recommends Jon Stief, a family law attorney, mediator, forensic accountant and consultant. Jon has worked with thousands of clients, families and other family law professionals to resolve issues.

“Take advantage of co-parenting apps to maintain records” says Stief. “Co-parents can use these apps proactively to improve communication and prevent issues from arising.” - Create a system for big-ticket expenses

Medwin encourages her clients to pay particular attention to how they will handle big-ticket expenses. "The larger the sum of money involved, the more crucial it becomes to devise a specific plan," advises Medwin.

Medwin often advises her clients to establish a dedicated fund where both co-parents can contribute money to tackle such expenses. This approach is like paying a monthly insurance premium to cover significant expenses that may arise in the future. "I suggest that co-parents engage in a discussion to determine the amount each can deposit into this trust account, solely designated for high-ticket items in the future," suggests Medwin. "And in the event that the funds are not utilized, they can always be directed toward benefiting the children." - Adopt a mindset that puts children first

"The primary focus for the majority of co-parents is to prioritize the best interests of their children," Medwin says. "However, it is not uncommon for individuals to become entrenched in financial matters and ego-driven conflicts. To address this, I often suggest that co-parents shift their perspective from a romantic partnership to a business relationship, with a shared objective of acting in the best interest of the child. This realignment allows for disputes to be managed in a manner similar to that of business partners working toward a common goal." - Develop and manage a detailed tracking system

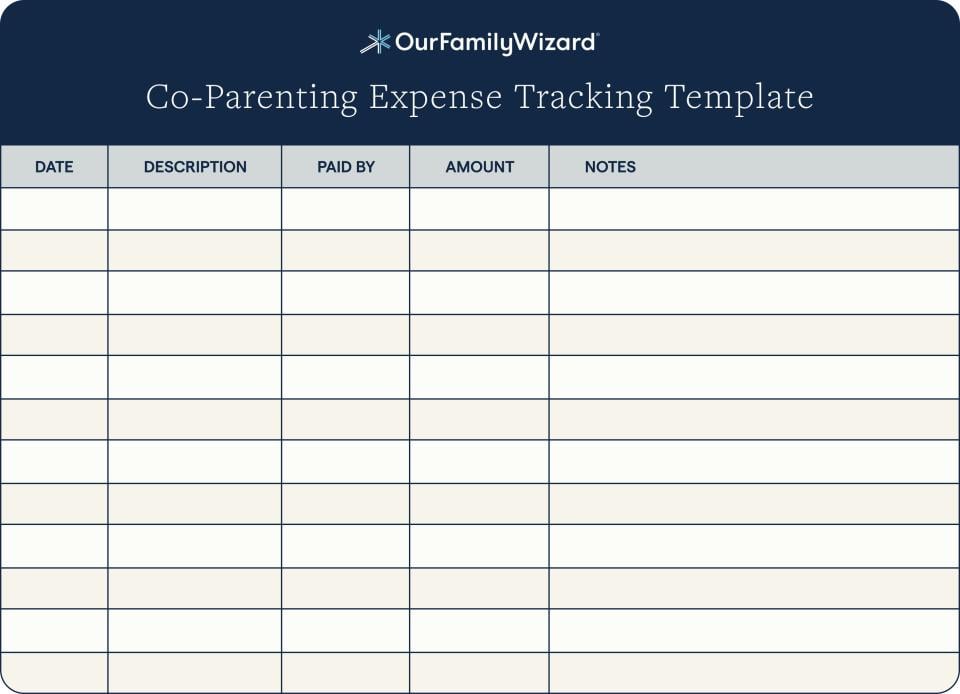

This is crucial to ensure transparency and accountability. Co-parents may want to record all shared expenses, including the date, description, and amount spent. You can simplify the process using spreadsheets, budgeting apps, or dedicated co-parenting expense management platforms. By maintaining an organized tracking system, both parents can easily refer to the records, review expenses, and ensure fair sharing of financial responsibilities. Robust tracking systems will also help co-parents resolve any potential disputes.

Download our Printable Co-Parenting Shared Expense Log Template for Excel or make a copy of our Printable Co-Parenting Shared Expense Log in Google Sheets to start tracking your co-parenting expenses today.

Co-parenting expense log to print off and manually fill in

Tips for Managing Co-Parenting Expense Disputes

Open, honest communication is essential for managing disputes. Also, keep detailed expense records. Above all, co-parents should focus on the common goal: the child’s well-being. If needed, you can seek outside help to avoid returning to court.

Even co-parents in cooperative relationships must manage child expense disputes from time to time.

Here are a few tips for navigating conflicts when they do arise:

- Be patient with the confusing expenses

"Managing medical bills and insurance claims can often be a perplexing process," acknowledges Burchell. "Frequently, one co-parent receives a notice from the insurance provider that only mentions the cost of treatments without indicating the total amount due. This language can confuse both co-parents. One may be unsure about the appropriate amount to submit, while the other may feel they are being asked to contribute more than necessary. When faced with such bewildering expenses, it's crucial to exercise patience toward one another and rely on a history of well-documented and fairly shared reimbursement."

"In my experience, it’s helpful for co-parents to consider the circumstances of the other person involved," says Stief. "It's crucial to remember that there may be more going on behind the scenes than meets the eye. Perhaps it's a matter of timing, and the other parent wouldn't mind contributing if suitable payment arrangements are made. Taking a moment to empathize and understand their perspective can go a long way in finding common ground."

During these moments of confusion, co-parents need to communicate openly and clarify any uncertainties. Maintaining a spirit of cooperation can help to resolve misunderstandings. - Accept that conflicts will arise and proactively plan for them together

“Conflict resolution is a skill,” says Medwin. “Co-parents can cultivate that skill with the help of a trained professional.” - Cultivate self-awareness around your money decisions

"Developing a sense of awareness and practicing self-reflection is essential when it comes to money-related decisions," advises Medwin. "Learning to engage in self-talk and self-questioning can help you discern whether your hesitation stems from a desire to maintain control over your ex-spouse or if it genuinely stems from a misalignment of values."

By cultivating self-awareness, co-parents can better understand the underlying motivations behind their financial choices. It enables them to differentiate between personal biases and genuine concerns about the child’s well-being. - Consider the implications of returning to court to negotiate an issue

"It's important not to underestimate the challenges and implications of returning to court," advises Medwin. "When you reach a point where you feel frustrated and tempted to pursue a legal resolution, take a moment to carefully consider what that process might entail."

Medwin emphasizes the benefits of co-parents working together rather than going to court. "Engaging in a collaborative approach is far preferable. No one wants to bear the financial burden of attorney fees associated with litigation. Additionally, if you don't achieve the desired outcome, you may find yourself responsible for both the expenses you were disputing and the associated legal costs."

Stief points out that, along with a financial burden, litigation carries a significant emotional toll. “Litigation often leads to anger and resentment” says Stief. “It’s in your family’s best interest to avoid returning to court.”

Medwin adds: "On the other hand, if you are unquestionably in the right, resorting to court and holding the other party in contempt can serve as a powerful incentive for improved behavior in the future."

By avoiding a court battle, co-parents can save themselves from unnecessary financial strain. The guidance of professionals often leads to more efficient and cost-effective solutions. They can enable co-parents to focus their resources on the child’s well-being, not legal proceedings. - Don’t bury your issues

"When faced with an expense that you feel is unjust, it may be tempting to simply accept it and hope to move on," explains Medwin. "However, it's important to recognize that the strength of your argument can diminish over time if you choose to keep it hidden. If you genuinely believe you are owed the money, I encourage you to take action and seek enforcement of your parenting plan." - Put the child’s experience first, even if it means personal sacrifice

"Prioritizing the well-being and experiences of your child should always be the guiding principle," emphasizes Medwin. For example, you might think a concert or a school trip is important for your child, but your co-parent disagrees. “One option is to personally bear the expense for the sake of your child,” Medwin says. “Sometimes, even if you are technically in the right, you may find that shouldering the cost is the simplest and most cost-effective solution."

“At the end of the day, every co-parent will need to use their self-judgment and awareness to balance the pros and cons of moving forward with a dispute or just moving past it.”

How to Create a Budget for Co-Parenting Shared Expenses

To create a budget, try digital tools like spreadsheets. On the spreadsheet, list anticipated expenses, consider each co-parent’s income, and regularly track and review actual costs. This practice will help you understand how much money you are spending.

Crafting a budget for co-parenting shared expenses can pose challenges, particularly when dealing with uncertain expenses or variable incomes.

Burchell says creating a budget can be challenging when you separate from a young child. “Unfortunately, you won’t have a crystal ball to predict what’s going to happen. Your 2-year-old hasn’t developed any expensive hobbies yet. They’re not going on trips to soccer tournaments or asking for expensive violin lessons. Plus, there are certain things you’ll never be able to predict, like a broken leg or arm.”

Burchell adds that planning with an older child becomes easier. In this case, it might be worth setting the time to make a budget. “If you split up with a 16-year-old, you probably already have a good grasp of their expenses. You can anticipate their medical bills and extracurricular commitments.”

If you’re interested in creating a budget, follow these steps:

- List shared expenses: Identify all the child-related costs you have agreed to share, like education, healthcare, and personal care. You can use our shared expense list as a helpful reference.

- Determine contributions: Discuss and agree on the amount each parent will contribute toward shared expenses. Consider factors like income and custody arrangement. For example, if a co-parent makes significantly more money than the other, it’s common that the co-parent will pay more toward an expense. Reference your parenting plan if you forget the specifics for a niche category.

- Add in the items you are solely responsible for: This approach helps you budget for all of your expenses, whether related to you or your child.

- Track expenses: Create a robust tracking system. For example, you can use our free co-parenting expense tracking templates or download an app like OurFamilyWizard. Whatever method you decide should include dates, descriptions, and amounts spent.

Download our free co-parenting shared budget template for Excel or make a copy of our co-parenting shared budget template for Google Sheets to stay on top of your co-parenting expenses.

Easiest Way to Track and Pay Co-Parenting Expenses

Make co-parenting expenses effortless. Use OurFamilyWizard's user-friendly tools for managing expenses to track spending, request reimbursements, and support your child.

With OurFamilyWizard’s Expense Log, co-parents won’t need to deal with the hassle of manual spreadsheets and the risk of missed payments. The intuitive interface helps users track their shared costs with detailed expense reports and more.

The Expense Log calculates each co-parent’s expenses based on the expense category and approval status. This feature ensures fairness and transparency, preventing conflict before it can arise.

The Expense Log also offers a secure online payment option through OFWpay™. Co-parents can confidently make payments, knowing their financial account information remains private and secure. Additionally, the expense statuses are automatically updated upon payment, maintaining accurate records and eliminating the need for manual updates.

OurFamilyWizard simplifies the financial aspect of co-parenting and promotes effective communication and collaboration. By providing a centralized platform for co-parents to manage their shared expenses, OurFamilyWizard’s co-parenting app encourages an open and honest co-parenting commitment.

Co-Parenting Shared Expenses FAQs

What expenses does child support cover?

Child support typically covers a child’s basic needs, including food, clothing, housing, healthcare, and sometimes educational expenses. Coverage can vary by state.

How to keep track of expenses as co-parents without child support involved?

Use shared spreadsheets, expense-tracking apps, or co-parenting apps to log payments for childcare, medical costs, and other shared expenses.

What are the three types of co-parenting?

Common types are parallel co-parenting (minimal contact, separate routines), cooperative co-parenting (shared planning and communication), and bird’s nest co-parenting (child stays in one home, parents rotate).