Co-Parenting Shared Expense Tracking Spreadsheets, Templates and Expert Advice

Raising children after a divorce can be challenging – and managing expenses can be overwhelming. Co-parenting expense tracking helps manage costs and minimize conflict. Explore expert tips and free templates to choose a system that works for everyone.

Inside this article

- Free, customizable Excel spreadsheet for co-parenting expense tracking

- Free, customizable Google Sheets for co-parenting expense tracking

- Free, printable co-parenting expense log

- Expert opinions on common expense management systems

- Why co-parenting apps are the easiest way to track and manage shared expenses

Sharing Expenses With Your Co-Parent

Sharing childcare costs is an important part of co-parenting. To avoid problems, co-parents should agree on a straightforward way to track expenses. A robust, transparent tracking system will reduce conflict and help the entire family.

“There are many different aspects to co-parenting. Keeping track of expenses is just part of the puzzle,” notes Jennifer Warren Medwin, MS, CDC, and Florida Supreme Court Certified Family Mediator.

“There are many different aspects to co-parenting. Keeping track of expenses is just part of the puzzle,” notes Jennifer Warren Medwin, MS, CDC, and Florida Supreme Court Certified Family Mediator.

“Money can create tension in even the most peaceful relationships,” Medwin says. “Co-parents must approach expense tracking and sharing mindfully. First, they'll need to set up an environment, either alone or with outside help, that fosters open communication and flexible thinking. Starting off with the right tracking system can be beneficial for everyone because it minimizes potential conflicts over finances.”

Typically, co-parenting shared expenses include all expenses outside of your court-agreed child support. These expenses include a child’s medical bills, school fees, extracurricular activities, and other costs beyond basic food and clothing.

“There are essentially four big ‘shared expense’ buckets,” says Elizabeth Burchell, family attorney at Busciglio, Sheridan & Schoeb and children’s book author. Elizabeth also represents children as a guardian ad litem, and volunteers at her non-profit, Chicktime Tampa, for teens in foster care. “The larger shared expenses we see in parenting plans are (1) uncovered medical expenses, (2) extracurriculars, (3) educational expenses, or (4) child daycare.”

“There are essentially four big ‘shared expense’ buckets,” says Elizabeth Burchell, family attorney at Busciglio, Sheridan & Schoeb and children’s book author. Elizabeth also represents children as a guardian ad litem, and volunteers at her non-profit, Chicktime Tampa, for teens in foster care. “The larger shared expenses we see in parenting plans are (1) uncovered medical expenses, (2) extracurriculars, (3) educational expenses, or (4) child daycare.”

Burchell says both co-parents are responsible for day-to-day expenses while the child is in their care. But, when a shared expense arises, the co-parents must decide mutually, based on the parenting plan.

“There’s a lot of room for misunderstandings when it comes to these shared expenses, and that can lead to additional litigation for the family,” Burchell says. “So, a solid tracking plan detailed in the parenting plan in the first place will reduce conflict in the future.”

After settling on a list of shared expenses, the next step is establishing a method for tracking expenses and payments.

Experts recommend that co-parents review tracking options carefully and discuss the pros and cons. Then, they should find a suitable method that minimizes conflict, helps shield children from financial stress and even avoid the need for future court appearances.

“It’s a cost-benefit analysis,” says Jon Stief, a family law attorney, mediator, forensic accountant and consultant. Jon has worked with thousands of clients, families and other family law professionals to resolve issues. “If a co-parent feels they have a claim for unpaid expenses, and they haven’t had a system in place, then they might spend a lot of money substantiating the monies owed, including the cost of a lawyer or accountant.”

“It’s a cost-benefit analysis,” says Jon Stief, a family law attorney, mediator, forensic accountant and consultant. Jon has worked with thousands of clients, families and other family law professionals to resolve issues. “If a co-parent feels they have a claim for unpaid expenses, and they haven’t had a system in place, then they might spend a lot of money substantiating the monies owed, including the cost of a lawyer or accountant.”

Stief adds: “Most methods fail without a system. Co-parents should be particularly cautious around sensitive issues like money. If it was easy to communicate, then many co-parents could avoid family law litigation. The evidence tells us communication is not easy, particularly around financial issues. But solid, structured expense tracking systems can make the process straightforward and eliminate potential miscommunication that could skyrocket into serious conflicts.”

Experts agree that establishing a structured and transparent expense tracking system can be critically important. However, tracking methods vary, and using a system that both co-parents understand and like is crucial.

“A system that works well for one co-parent can overwhelm the other,” says Burchell. “For example, one co-parent might love a spreadsheet. And that could completely overwhelm the other.”

The more simplified and structured the plans, the more likely each co-parent will be on board.

“Both co-parents need to be mindful of the way the other co-parent processes and receives financial information,” Burchell says.

Options to Help Co-Parents Manage Shared Expenses

Co-parents can manage their shared expenses in various ways. For example, you can open a joint bank account for shared expenses. Many co-parents find that a co-parenting app with expense tracking is the best, most transparent way to track and manage costs.

Different tracking systems suit different types of co-parenting situations. Experts recommend that co-parents honestly assess their relationships, especially since money can strain even the healthiest relationship.

Tiffany D. Thompson-Disler, a family law attorney, recommends that co-parents take a broad view of their relationship before diving into the details. These conversations will help co-parents assess each tracking system as it pertains to them.

Tiffany D. Thompson-Disler, a family law attorney, recommends that co-parents take a broad view of their relationship before diving into the details. These conversations will help co-parents assess each tracking system as it pertains to them.

"Co-parents should consider their level and ease of communication with one another,” says Thompson-Disler. “For example, some co-parents can communicate well in a variety of ways, whereas some co-parents only communicate well in writing. Finding a way to track and share expenses that take the co-parent relationship into consideration can be extremely helpful, especially in high-conflict cases.”

Stief advises: "Co-parents should assess their ability to communicate, their privacy concerns, their comfort level with money and math, the level of mutual trust in their relationship, and their willingness to establish and adhere to guidelines."

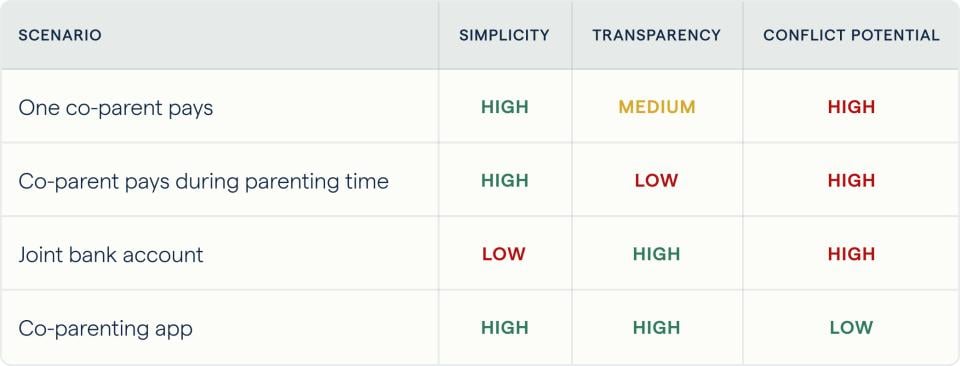

As these experts note, co-parents should assess various factors when deciding on a system. Here's a summary of the most common ways co-parents track and manage expenses, including pros and cons.

Option 1: One co-parent pays, and the other reimburses

In this system, one co-parent pays most expenses while the other reimburses. This system works only when the co-parents trust each other and earn similar incomes.

“When one co-parent pays expenses and the other reimburses, the co-parents must be very organized and cooperative,” Medwin says. “Mostly, the co-parents need to have a high level of trust in their relationship. Otherwise, they will wind up debating every expense, which can lead to contentious conversations and power struggles that the children will inevitably absorb. “

Here are the pros and cons to consider:

Pros

- Simplicity

This approach can be simpler than trying to split expenses evenly or creating a complicated system for who pays what. With one co-parent taking care of payments and the other reimbursing their share, there will be less back-and-forth expense tracking. - Clear expectations:

When one co-parent pays for something, it can be easier to establish clear expectations about what the other co-parent owes, reducing confusion and conflict. - Little communication

This method does not demand as much communication between co-parents, which can be a pro for co-parents in contentious relationships.

Cons

- Delayed reimbursements

“The obvious con to having one co-parent pay is that the reimbursing co-parent may be unresponsive or unwilling to contribute,” says Thompson-Disler. “This negligence can cause frustration and financial strain on the paying parent."

Burchell notes that "a delayed reimbursement can lead to a chain reaction of financial burdens. For instance, if your co-parent fails to pay their portion of the childcare expenses, you may need to cover both shares to keep your child enrolled. - Requires proof of payment

The paying co-parent must submit invoices for every shared expense, which can become tedious. This aspect may sound like a nuisance, but it can lead to significant headaches and money lost.

“Parenting plans often include language that requires a parent to provide proof of payment within a certain amount of time,” explains Stief. “If you fail to do so, then you waive your right to collect, leading to lost money.” - Disputes over expenses

If co-parents have different opinions on what expenses are necessary or how much they should cost, disputes may arise when one co-parent pays for something and expects reimbursement from the other.

“Co-parents find ways to disagree about what should be included as a reimbursement, even when the parenting plan has explicit language detailing the responsibilities of shared expenses,” cautions Stief. - Difficult to maintain over an extended period

“People may like the idea of a joint account in year 1 or 2,” comments Stief, “but what if it’s an extended period and there are new spouses or significant others? For example, what will happen when children are older and want access to the account?”

Option 2: Each parent pays for expenses that fall in their parenting time

Each co-parent pays for whatever expenses fall in their parenting time, excluding child support. Co-parents have autonomy over how they spend their money.

Most experts do not recommend this system because large, unexpected expenses threaten to cause significant conflict. But some co-parenting relationships may be able to handle this system.

Medwin says this system could work if co-parents agree and settle out of court.

"However, this method may only work in rare situations where time-sharing is equal, and both co-parents have similar levels of financial independence and comparable income," Medwin says.

“This system is the default method for day-to-day expenses but quickly falls apart when larger, unexpected expenses crop up,” adds Burchell. “Doctor’s appointments fall where they fall. Designating expenses based on the co-parents’ time can get messy quickly.”

Here are this system’s pros and cons:

Pros

- Simplicity

In theory, you won’t need to track your expenses with this shared expense method. This system should require less coordination between the co-parents, reducing potential conflicts over money. - Equal financial responsibility

This approach gives each co-parent the onus to cover expenses that arise during their parenting time, which can promote financial equity and provides the co-parent with total autonomy over what they determine to be appropriate expenses. - Greater control

Each co-parent has greater control over how they choose to spend their money, which can reduce conflict over which expenses are necessary or appropriate.

Cons

- Uneven expenses

If one co-parent's parenting time involves more expenses than the other, this can create an imbalance in financial responsibility. For example, suppose one co-parent has custody during the school year and is responsible for covering school-related expenses. In that case, they may have a higher financial burden than the other co-parent. Even if parents discuss this issue beforehand, it may still cause conflict later - Difficulty managing unexpected expenses

This system can create confusion and uncertainty, particularly in the case of an unexpected expense. For example, how will the co-parents navigate the bills for a costly medical expense during one co-parent’s time? - Can breed distrust

“If one co-parent perceives that they are frequently more responsible or common shared expenses, resentment may follow,” warns Stief. “For example, one co-parent might feel they always take the child to the doctor and pay 100% of the co-pay. The paying co-parent might feel that the other co-parent purposefully avoids doctors because they know the first co-parent will handle the fees.”

Option 3: Joint bank account for children’s expenses

Another way to manage finances is to open a joint bank account to contribute money for shared expenses. Co-parents who use this system usually describe how each parent will fund the account in their financial agreement.

Usually, they decide on a fixed amount for both parents to contribute monthly. Other parents may fund the accounts as needed as joint expenses outside child support arise.

According to Burchell, there are more effective methods for co-parents to track and manage expenses than joint bank accounts. "I have never come across a case where we felt a joint bank account would work for co-parents," she says. "This method will challenge the trust level of the relationship between the co-parents and could easily lead to conflicts. We do not often consider this method realistic, save for some rare co-parents who have extremely amicable relationships."

Here are this system’s pros and cons:

Pros

- No need to track reimbursements

In a joint bank account, you will not need to deal with reimbursements because you can use the account directly to fund any expenses as they arise. - Increased transparency

With a joint bank account, both co-parents can see all transactions. This system can help promote transparency and reduce potential conflicts over money.

Cons

- Lack of clarity over eligible expenses

“While general language like "child-related expenses" may suffice when parents are getting along, it can lead to issues when disagreements arise,” cautions Stief, family law attorney. “Even when co-parents use a specific list of expenses, one co-parent still may misinterpret the category of an expense and use the shared fundings for something that the other co-parent may consider an inappropriate expense.” - Misused funds

Co-parents that run a joint bank account must define each parent’s account ownership status, online access, and debit cards. “Co-parents that share a joint bank account run the risk that someone will misappropriate the funds, which can add to conflict,” says Thompson-Disler. This situation could easily lead co-parents back to litigation.

Option 4: Co-parenting app

Co-parenting apps provide a centralized platform to manage and track shared expenses. These apps allow parents to track and share bills like medical expenses, school fees, extracurricular activities, and other costs associated with parenting. Parents can easily upload receipts, categorize expenses, and split costs based on pre-determined percentages. Most apps also link with banks or other payment services to handle reimbursement on the app itself.

From an expert perspective, there’s no question. They frequently recommend co-parenting apps for all co-parenting situations. Co-parents with high-conflict relationships will particularly benefit from these apps.

- Thompson-Disler: “Co-parenting apps are the best way to share expenses. They are easy to use, and each family can customize the app to fit their specific needs. Also, clients report that it’s easy to link their bank account to pay directly in the app, streamlining the whole process.”

- Medwin: "Co-parenting apps provide a complete and efficient solution for managing all expenses related to co-parenting. From tracking expenses and uploading and categorizing receipts to generating customized reports and requesting or receiving payments, these apps offer an organized and transparent approach that removes direct communication and emotions from financial transactions, effectively minimizing conflicts."

- Stief: "Co-parenting apps are a valuable tool that benefits everyone involved. They assist in communication, track, and calculate expenses, hold up in court, and promote clarity and accountability. When there's clarity, there is less fear and animosity, and co-parents can focus on the best interests of their children. Even if co-parents communicate well today, having clarity on shared expenses can prevent future conflicts and promote respect, reduce stress, and enhance co-parenting abilities."

- Burchell: “Using a co-parenting app is the best way to track expenses. These apps enable you to document the time an expense occurred, generate an expense report, create an invoice request, and provide details on when the other party viewed and paid. This level of detailed documentation provides a layer of comfort to both parties.”

Here are the pros and cons of using a co-parenting app to manage and track expenses:

Pros

- Centralized platform

A co-parenting app provides a centralized platform with a high-level view and a detailed view of expenses. In addition, it ensures that both parents have access to the same information. - Increased transparency

Co-parenting apps feature full transparency because both parents can see exactly how much money each spent – and on which items or activities. This level of transparency can help reduce misunderstandings and conflicts over shared expenses. - Simple reimbursement

Most co-parenting apps easily link to each co-parent’s financial institution. They also provide ways to request and receive reimbursement for shared expenses. Also, the apps can automatically calculate and submit reimbursement requests based on the parenting plan’s pre-determined expense percentages.

Cons

- Cost

Some co-parenting apps charge a subscription or have associated fees. Though these apps are inexpensive, co-parents must weigh the small additional cost. - Technology challenges

Technical issues are rare but can occur and potentially cause delays in managing shared expenses. These issues include connectivity problems or device compatibility problems.

Co-parenting Shared Expense Templates

Our co-parenting templates offer a basic, systematic way for co-parents to track shared expenses. Compare our free templates and choose the one that best fits your needs. Whether you prefer a printable log sheet to manually track your expense or want a detailed expense tracking spreadsheet, we have you covered. Each template is available in both Excel and Google Sheets.

- Printable co-parent expense tracking template

You can use this printable co-parenting expense log to track expenses the old-fashioned way—with paper and pencil. Each row contains a different expense that you can categorize by type. You will also put the name of whoever paid for the expense. Then, at the end of the month, you can total each co-parent’s expenses and any amount owed. This method is a straightforward way to track the costs.

Download our Printable Co-Parenting Expense Log Template for Excel or make a copy of our Printable Co-parenting Expense Log in Google Sheets to start tracking your co-parenting expenses today.

Co-parenting expense log to print off and manually fill in

- Co-parenting expense tracking spreadsheet

Spreadsheets can help make co-parenting expense tracking easier. Our customizable spreadsheet has a sheet for your expenses and other sheets that automatically create expense summaries to help you keep track of your financial responsibilities. Our spreadsheet template is customizable, so you can make it even more detailed or streamline it. For example, you can include different categories to organize your expenses by type. The co-parenting expense spreadsheets help parents understand and track their financial responsibilities.

Consider using version tracking and locked cells to safeguard your data against accidental changes or meddling. Version tracking allows you to compare changes made to the sheet. Locked cells enable password protection for certain cells, like a specific expense so that only you can edit that cell’s value.

Download our Co-Parenting Expense Tracking Template for Excel or make a copy of our Co-Parenting Expense Tracker in Google Sheets to start tracking your expenses today.

Co-parenting expense tracking spreadsheet

Easiest Way to Track Co-Parenting Expenses

OurFamilyWizard’s all-in-one co-parenting app includes an Expense Log to manage, track, and pay shared expenses. This streamlined expense tracking system helps you spend more time on family, not finances.

The Expenses feature on OurFamilyWizard simplifies the process of co-parenting expenses, from entering the initial cost to receiving a reimbursement from your co-parent. For example, if you and your co-parent split dental costs for your children and you just took one to an appointment, you can add that cost to your Expense Log to ask for a reimbursement. You can even upload a copy of the receipt of invoice to share with your co-parent.

Once your co-parent reviews and approves the expense, they can reimburse you for it via the secure, in-app payment system called OFWpay™. You’ll be notified at every step of the way, from the time your co-parent submits a payment to when it’s deposited to your bank account. The app even generates simple and immediate expense reports that total your expenses, calculate how you split costs by category, and shows payment or reimbursement statuses.

If there are any expense or payment discrepancies, you can use OurFamilyWizard’s messaging system to communicate with your co-parent about those matters in a well-documented place. This lets you have financial discussions in a centralized platform instead of endless text and e-mail threads that are easily lost or, worse, could be tampered with.

Experts resoundingly agree: OurFamilyWizard will improve expense tracking with your co-parent and can help to minimize conflict over shared costs.